Us paycheck tax calculator

On the other hand you may want to shrink the size of each paycheck for tax reasons. Figure out your filing status.

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Tip Tax Calculator If you receive tips in your paycheck this calculator will help you estimate the withholdings every pay period.

. The tax rates used in the calculator may not necessarily apply to you. If your paychecks seem small and you get a big tax refund every year you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. A financial advisor in Arkansas can help you understand how taxes fit into your overall financial goals.

Historically the most common work schedule for employees across the United States is an 8-hour day with 5-days per week. This calculator is intended for use by US. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Dont want to calculate this by hand. Enter your pay rate. For 2020 an eligible employer is entitled to a refundable credit equal to 50 of qualified wages paid from March 13 2020 through December 31 2020 plus qualified health plan expenses up to 10000 in qualified wages per employee resulting in a maximum.

How Income Taxes Are Calculated. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use. Figure out your filing status.

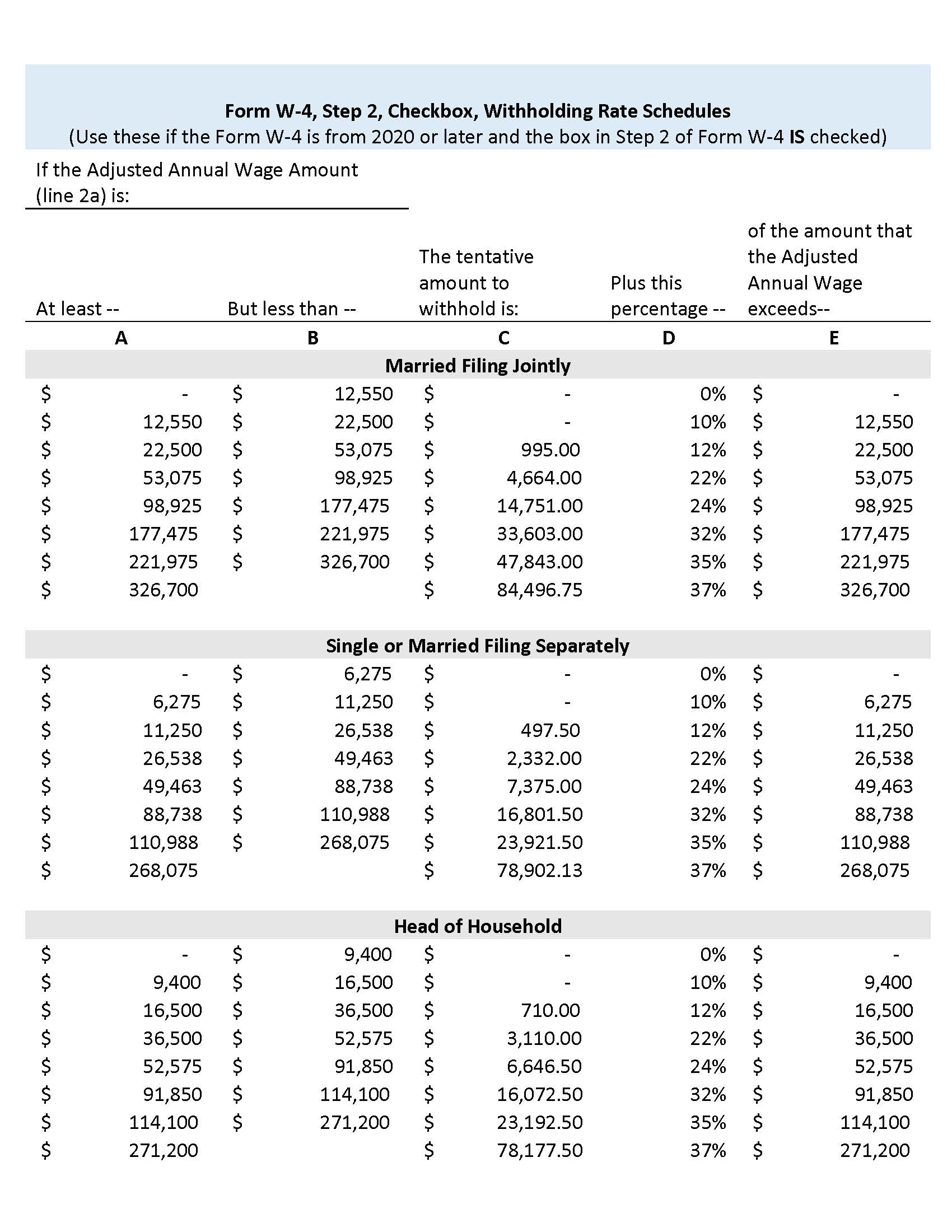

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. You can use the calculator to compare your salaries between 2017 and 2022. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

It can also be used to help fill steps 3 and 4 of a W-4 form. Employers also withhold federal income tax from each of your paychecks. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

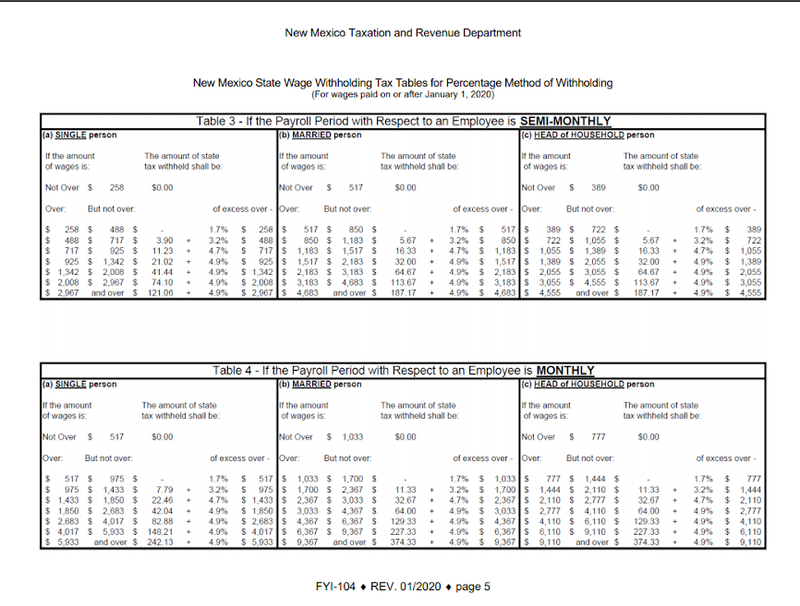

Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. In the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. If you work 40 hours a week then converting your hourly wage into the weekly equivalent is easy as you would simply multiple it by 40 which means adding a zero behind the hourly rate then multiplying that number by 4.

Use the goal slider to see the impact of the different retirement goals. California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll. Its your employers job to withhold federal income tax based on the information you provide on your W-4 form.

This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations. So the tax year 2022 will start from July 01 2021 to June 30 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Your household income location filing status and number of personal exemptions. The PaycheckCity salary calculator will do the calculating for you. Our calculations assume that the employee has already received the tip.

Choose Tax Year and State. The total ERC benefit per employee can be up to 26000 5000 in 2020 and 7000 per quarter in 2021. Usage of the Payroll Calculator.

Arkansas residents can tweak their paychecks in a few. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. This number is the gross pay per pay period.

Send us a message. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy. If youre getting a big tax bill every year you might want to fill out a new W-4 form and request additional withholding.

Texas state income tax. Subtract any deductions and payroll taxes from the gross pay to get net pay. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

Overview of Louisiana Taxes. The calculator is updated with the tax rates of all Canadian provinces and territories. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

The Paycheck Calculator below allows employees to see how these changes affect pay and withholding. Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Louisiana has three state income tax brackets that range from 200 to 600. Your feedback is very important to us. The calculator will show you approximately how much you should contribute each paycheck to reach your desired retirement goal.

Minnesota tax year starts from July 01 the year before to June 30 the current year. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you itemize deductions on Schedule A Form 1040.

How You Can Affect Your Arkansas Paycheck. Use this free paycheck calculator to determine your paycheck based on an hourly salary. Lowest price automated accurate tax calculations.

Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck. How much you pay in federal income tax is based on factors like your salary your marital status and if you asked for an additional dollar withholding. If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with.

2021 2022 Paycheck and W-4 Check Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Try paystub maker and get first pay stub for free easily in 1-2-3 steps.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Follow the steps below to calculate your take home pay after state income tax. Call us at 1-877-525-7655 to speak with a consolidation specialist.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes. Use our free check stub maker with calculator to generate pay stubs online instantly. Texas tax year starts from July 01 the year before to June 30 the current year.

The amount can be hourly daily weekly monthly or even annual earnings. NW IR-6526 Washington DC 20224. You can send us comments through IRSgovFormComments.

The tax withholding rate on supplemental wages is a flat 35. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

Payroll Tax Calculator For Employers Gusto

Paycheck Calculator Online For Per Pay Period Create W 4

Tax Payroll Calculator Outlet 54 Off Www Wtashows Com

How To Calculate Federal Income Tax

How To Calculate Payroll Taxes Methods Examples More

Payroll Calculator 2020 Deals 55 Off Www Ingeniovirtual Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Tax Calculator For Weekly Pay Best Sale 58 Off Www Ingeniovirtual Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Federal Income Tax Fit Payroll Tax Calculation Youtube

Tax Calculator For Paycheck Store 52 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

Tax Calculator For Weekly Pay Best Sale 58 Off Www Ingeniovirtual Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate Taxes On Payroll Sale 53 Off Www Ingeniovirtual Com

1wxmydejhzto9m